PCI Assessment: What Do You Need to Be Compliant?

What Is PCI Assessment? Requirements, Benefits, and Risks

If your business accepts, processes, stores, transmits, or provides security to protect credit card information, PCI DSS compliance (Payment Card Industry Data Security Standard) isn’t optional; it’s a fundamental and contractual requirement of organizations to the payment card brands, issuers, and acquirers for protecting customer payment data and maintaining trust.

Developed by the Payment Card Industry Security Standards Council (PCI SSC), PCI DSS establishes a set of security standards designed to ensure all companies that handle cardholder data do so securely. Compliance is enforced by major card brands including Visa, Mastercard, American Express, Discover, Union Pay and JCB.

The goal of PCI compliance is simple: reduce payment card fraud and data breaches by safeguarding sensitive financial data throughout every stage of the transaction lifecycle.

PCI Compliance Requirements

PCI DSS outlines 12 core requirements built around six major control objectives. These requirements ensure that cardholder data is protected at every level of your systems, networks, and processes.

Build and maintain a secure network and systems

- Install and Maintain Network Security Controls.

- Apply Secure Configurations to All Systems

Protect Account data

- Protect Stored Account Data.

- Protect Cardholder Data with Strong Cryptography During Transmission Over Open, Public Networks.

Maintain a Vulnerability Management Program

- Protect All Systems and Networks from Malicious Software.

- Develop and Maintain Secure Systems and Software.

Implement strong Access Control Measures

- Restrict Access to System Components and Cardholder Data by Business Need to Know.

- Identify Users and Authenticate Access to System Components.

- Restrict Physical Access to Cardholder Data.

Regularly monitor and test networks

- Log and Monitor All Access to System Components and Cardholder Data.

- Test the Security of Systems and Networks Regularly.

Maintain an information security policy

- Support Information Security with Organizational Policies and Programs.

These standards apply to any organization that handles payment card data, regardless of size or transaction volume.

Benefits of PCI Compliance Assessment

Achieving PCI DSS compliance delivers far more than a certification — it demonstrates your organization’s commitment to data protection, transparency, and trust.

Key benefits include:

- Reduced risk of breaches and fraud: A compliant environment minimizes opportunities for data theft.

- Enhanced brand reputation: Compliance signals to customers that their payment information is safe with you.

- Reduce third parties exercising their right to audit you if they also need to be PCI DSS Compliant.

- Avoid the requirement to do Reports on Compliance (ROC) for several years if you get breached.

- Simplified audit and regulatory alignment: PCI frameworks complement other compliance programs like SOC 2, ISO 27001, and HIPAA.

- Operational efficiency: Standardized controls and monitoring processes improve overall cybersecurity posture.

Risks of Not Getting a PCI Assessment

Failing to comply with PCI DSS can have severe consequences that go beyond financial penalties.

There are different PCI mistakes to avoid and other potential risks include:

- It can affect cyber-insurance rates and eligibility.

- Hefty fines and fees from card brands or acquiring banks.

- Legal liabilities resulting from data breaches.

- Reputational damage and loss of customer trust.

- Loss of card processing privileges can significantly disrupt business operations.

Expert Tips from Our PCI Compliance Experts

- Start with a readiness assessment: Identify your compliance gaps before beginning a formal audit.

- Look to ensure you only keep the data you need. Embrace technologies with advanced PCI Certification, such as P2PE.

- Document everything: Maintain detailed evidence of controls, monitoring, and remediation.

- Train employees regularly: Human error remains one of the top causes of non-compliance.

- Partner with a qualified PCI assessor: Expert guidance ensures an efficient and successful audit process.

Types of PCI Compliance Reporting

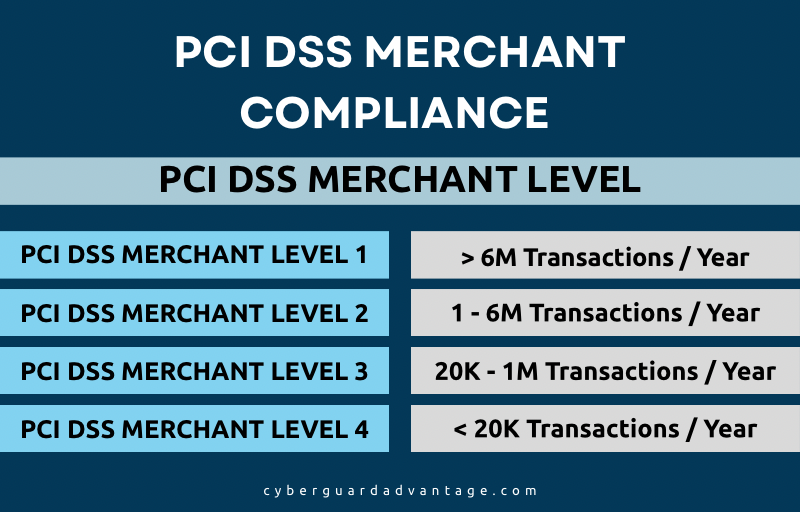

PCI DSS compliance isn’t one-size-fits-all. There are four PCI levels; these are brand-specific and determined by annual transaction volume. As a note, you need to understand that these levels are brand-specific, and not all brands have four levels:

|

Merchant Level |

Annual Transaction Volume |

Validation Requirement |

|

Level 1 |

Over 6 million |

Annual on-site assessment by a QSA and quarterly network scan |

|

Level 2 |

1 to 6 million |

Annual self-assessment questionnaire (SAQ) and quarterly scan |

|

Level 3 |

20,000 to 1 million (e-commerce) |

Annual SAQ and quarterly scan |

|

Level 4 |

Fewer than 20,000 (e-commerce) or up to 1 million (other) |

Annual SAQ and quarterly scan |

Example for a chart for PCI Levels:

These levels help determine your validation process, whether you need a Qualified Security Assessor (QSA) audit or can self-assess through an SAQ.

How you validate your requirements for each level will depend on your contracts and how they fit into the overall ecosystem. These rules are for merchants reporting through a “compliance accepting entity”.

A large merchant could engage service providers and require Reports on Compliance (ROC) regardless of any brand level. It would need to be in the contract.

What Does It Cost for a PCI Assessment?

Costs vary depending on the environment and the type of assessment. The final budget will depend on the scope and selected architecture. There is also a significant difference in pricing when an organization is becoming compliant versus one that is sustaining its compliance status.

Factors influencing cost include:

- Scope and complexity of your environment.

- Required technology or control upgrades.

- Consulting or QSA audit fees.

- Number of card acceptance/processing flows.

Investing in compliance may seem costly, but the average cost of a data breach far exceeds it, making PCI certification a proactive financial safeguard.

PCI Compliance Checklist – Achieving PCI DSS Compliance

Here’s a high-level checklist to guide your compliance journey:

- Determine your PCI level with the help of a Qualified Security Assessor (QSA), who will provide a Self-Assessment Questionnaire (SAQ)

- Conduct a gap or readiness assessment.

- Identify and segment your cardholder data environment (CDE).

- Implement controls and policies that align with PCI DSS requirements.

- Perform vulnerability scans and penetration testing.

- Remediate any findings and document evidence of compliance.

- Submit your Attestation of Compliance (AOC) to your acquiring bank or payment brand

Need help streamlining your PCI process? Learn more about our PCI Compliance Services and how our assessors can help you achieve certification with confidence.

PCI Compliance FAQ

What does PCI DSS compliance mean?

- PCI DSS compliance means your organization meets the security standards designed to protect payment card data from theft and misuse.

Who needs PCI DSS compliance certification?

- Any business that stores, processes, or protects cardholder data must comply — including merchants, service providers, and payment processors.

What are the PCI DSS compliance levels?

- PCI levels range from 1 to 4 and are brand-specific. Not all brands have four levels, and higher levels require formal audits and more rigorous validation.

What does it cost to be PCI DSS compliant?

- Costs depend on organization size, scope, and level, ranging from a few thousand to several hundred thousand dollars annually.

Am I responsible for a PCI DSS Compliance Self-Assessment Questionnaire (SAQ) and Report on Compliance (ROC)?

- Yes. Unless your organization undergoes a Level 1 on-site audit, you’re responsible for completing an SAQ and ROC annually to validate compliance.

PCI DSS compliance is more than a security checkbox; it’s a framework for trust, resilience, and business continuity. As threats to payment data evolve, staying compliant not only protects your customers but also strengthens your competitive advantage.

Ready to take the next step toward certification?

Connect with a PCI Compliance Expert at CyberGuard Advantage to start your PCI readiness assessment today.